, Group Planning Director at TMW

Before a brand commits to any social media campaign, activity or platform it’s clearly essential to understand how their target audience behaves in these environments. For example, which environments does your target audience frequent? How active are they in this space? Are they the types of people who proactively share and contribute to the conversation or do they prefer to observe by the sidelines? Are they likely to invest time and energy in UGC or would such an invitation fall on deaf ears? What are the motivations and key drivers that lie behind their social media behaviour?

Unless one can answer these types of questions, there’s a fair chance your social media efforts could all be in vein. The good news, however, is that there are a number of sources, tools and frameworks available which can help us build a fairly informed picture of our target audience’s social media profile. And the best bit, most of them are completely free! Outlined below are the ones I’m most familiar with or have found to be most useful over the years. I’ve also restricted the list to those tools which can be applied across European markets and not just the US.

1. The Global Web Index

The Global Web Index (Lite) is a nifty little free tool recently published by Trendstream to help you view the social media profiles of different online audiences across Europe. It’s based on a quantitatitive survey and manages to overlay social media behaviour and motivations by country, age and attitudinal profiles. The full version will have a lot more meat on the bones but for a quick snapshot this Lite version can be quite an insightful tool, particularly when comparing against different markets.

2. Universal McCanns Social Media Tracker

This in my view is the holy grail when it comes to tracking trends in social media from a global perspective. It’s been going a few years now and is an essential point of reference for anyone trying to identify behavioural trends in social media. There’s a free Silverlight-based tool here which is quite fancy but for usable insights and stats you really need to read the Wave 4 report . Pure gold dust!

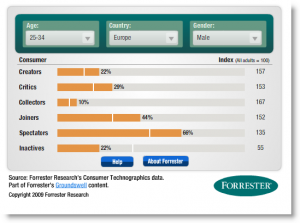

3. Forresters Social Technographics Tool

Forrester’s social technographics tool has been around for a while but is still a great way to map your target audience’s propensity to participate in social media. With this tool you can get a decent idea whether your audience over indexes for certain types of behaviour. So for example, if they over index as ‘creators’ there’s a fair chance they’d be receptive to getting involved in a crowdsourcing or UGC project. Conversely, if they’re predominently spectators and inactives, don’t even go there!

Unfortunately some European markets are not covered for some age profiles which I assume is because they don’t hold enough survey data but for broad, topline assessment of socialgraphics it’s a great place to start.

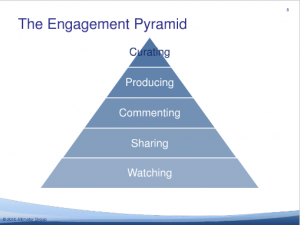

4. Altimeter’s Engagement Pyramid

This isn’t a data analytical tool as far as I believe but rather a strategic framework to help map the different ways in which consumers engage in social media. Even though there’s no data to substantiate this, it’s good common sense and highlights the importance of socialgraphics to help inform social media strategies rather than simply relying on traditional demographic and psychographic profiles. If you want to know more about this interesting approach I’ve reviewed it more fully on my blog.

5. TMW’s Motivational Drivers to Social Media Participation

Understanding ‘how’ your target audience participates in social media is key but only one piece of the jigsaw. It’s also important to ask yourself ‘why’. At TMW, we conducted some research in conjunction with research agency ICM to help identify the motivations behind social media participation. We concluded there are 6 key motivational drivers for participating in this space.

* Discovery: for self-development or to learn from others

* Altruism: to help others make the right decision or become involved in the brand’s product decision

* Social: to connect to the like minded, reinforce tribal identity or gain a sense of belonging

* Fame: for personal notoriety or to challenge their ability against others

* Escapism: for entertainment and an escape from the daily routine

* Expression: as an outlet for their imagination or expression of personal identity

The interesting thing is that these motivations change according to different demographics. You can read some of the insightful results from this study on my blog here where we explore the differences in motivations between gender and age.

6. TGI Net Europa

Launched in September 2008, with new data released twice a year, TGI Net Europa combines the full TGI Europa database with extensive detailed information on internet behaviour and attitudes. To be fair it’s probably more useful to draw broader conclusions on internet behaviour for a given target audience than building robust socialgraphic data. It’s not a free tool either so if you want access this type of data you may have to ask your media agency nicely!

7. Social Media Statistics Compendium by econsultancy

The Social Media Statistics Compendium is one of the reports bundled with the eConsulancy’s Internet Statistics Compendium. It costs £250 on its own but is jam packed with useful stats on social media from a variety of third party sources.

The Social Media Statistics Compendium is one of the reports bundled with the eConsulancy’s Internet Statistics Compendium. It costs £250 on its own but is jam packed with useful stats on social media from a variety of third party sources.

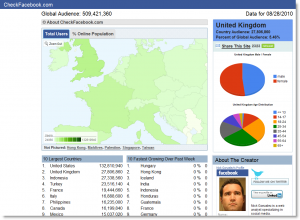

8. CheckFacebook.com

If you want to understand the profile of Facebook users within your country and compare this to your target audience profile, it’s worth visiting . It’s free too.

9. Nielson’s Global Faces & Networked Places Report – March 2009

Nielson’s Global Faces and Network Places report looks at the social media market as a whole but does have a useful section on how the audience is changing and starting to mature.

10 IAB Online Audience Research

Last but not least, there are a number of helpful online research papers available to IAB members including some for specific audiences such as women, Mums and luxury consumers)

Summary

So there you have it – a mix of tools and approaches to help you build up a social media profile of your target audience. It’s not an exhaustive list by any stretch of the imagination so if you know any more I may have missed feel free to add them below.